Want to know why we decided to use the 529 plan to save for our kids very near education expenses? It all starts with our parents and generosity.

Our parents are generous to us and our children. We would be struggling without their help through time and financial investments. Recently, I was looking at our budget and realized we had $2000 set aside for investing into school/college tuition. The idea of investing early in their life means we can gradually build up enough to pay for any their K-12 and college tuition once they reach that age. Here’s a summary of what we found:

ESA

The best part about the ESA was the flexibility of investing in anything you want. The 529 restricts your investments to the portfolios they provide. The ESA is like a regular brokerage account that gives you tons of flexibility. The main drawback is a $2000/year contribution. The other advantage of ESA until 2018 was more flexibility with the ESA. That’s no longer the case. Which is why the 529 as of year 2018 is tarting to sound much better.

529

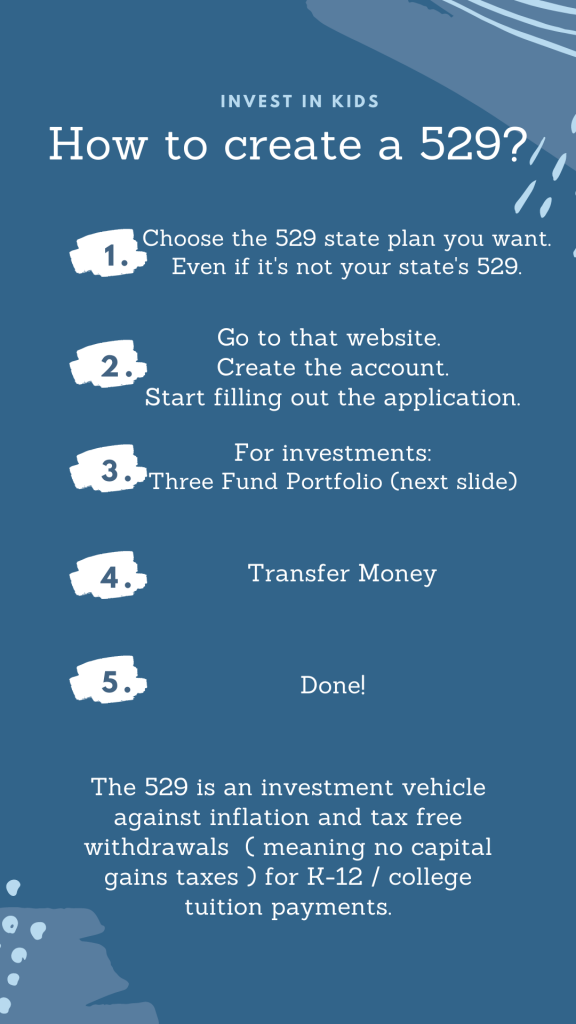

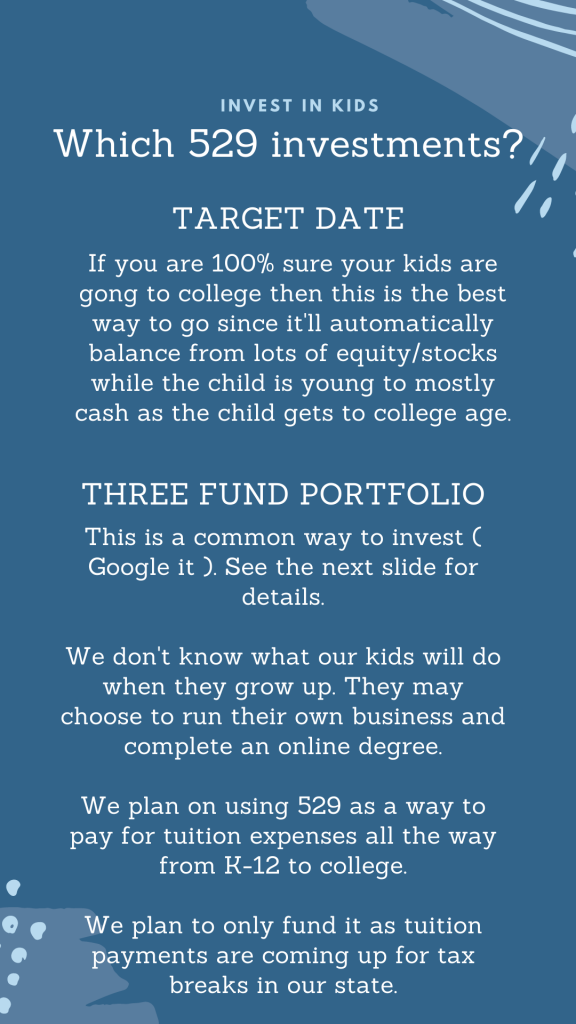

The 529 has pretty much all the advantages of the ESA and as of 2018 it can now be used to pay for tuition of K-12 as well. After talking to our friend Neil, who has been in the banking industry for many years, we’ve decided to open up a 529 account and fund it.

Here’s how we plan on using the 529.

- Open the 529

- Fund the 529 with what we want to spend on private/public tuition for our kids.

- Let the money grow.

- Once in school, withdraw money (tax-free) to pay for the tuition.

Originally, the 529 didn’t make sense to me because I didn’t understand that the money in your bank account is losing value ( due to inflation ) each year. Where as the money in a 529/ESA/brokerage account can continue to gain value.

Custodial Brokerage

The reason I bring up the custodial brokerage account is because I thought this is the route we’d go due to most flexibility. While true, this doesn’t allow us to take advantage of the tax breaks on tuition education. If we were in a position where we had “too much money” and couldn’t take advantage of the 529/ESA plan then at that point this plan would be more advantageous.

Decision

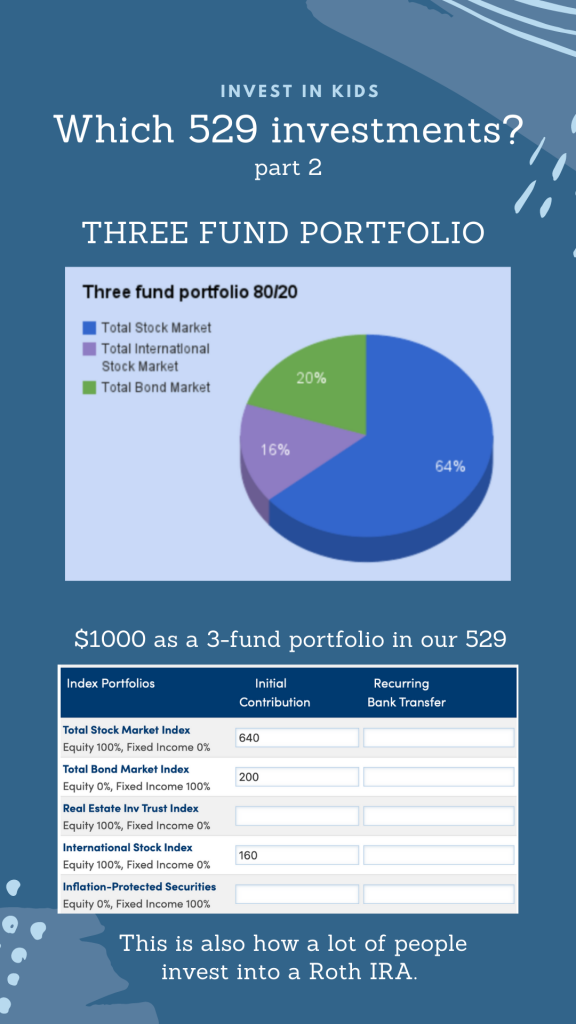

There you have it. We’ve decided to go with the 529 plan to invest the money our parents gave to our kids. Once the plan is all setup we’ll make yearly contributions as a way to pay for each year of tuition for our kids from the investment account.

Follow me on Instagram @alxgoryuk and Twitter @alxgoryuk for more wealth building tips.

Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.